Guiding Through European Company Registration: An Insightful Handbook

As small and big companies are looking forward to expanding their business globally, navigating international regulations may seem a complex procedure.

European countries are especially a preferred market for many investors because of their diverse trades and strategic geographical location.

The European economy ranked the sixth largest GDP in 2022, much ahead of Russia and Turkey.

Knowing about the complete process of starting a new venture is paramount to gauging the capital investment and infrastructure facilities available.

This article provides a step-by-step guide to managing registration, documentation, and identification appropriately.

We are exploring the three promising European destinations: Cyprus, Bulgaria, and Hungary for a seamless experience of your business expansion.

Registering A Company In Cyprus

Cyprus provides an entrepreneur-friendly environment with a strategic location, competitive tax rates, and modern infrastructure — an ideal European base.

THINGS TO CONSIDER

While Cyprus maintains a lower corporate tax at 12.5%, it also boasts an extensive network of double tax treaties.

These are the significant steps for registering a company in Cyprus:

- Choose a company name. Ensure the name is unique, complies with local naming rules, and is available for registration.

- Determine the legal entity. Search for the appropriate company structure, such as a Private Limited Company (Ltd) or a Public Limited Company (PLC).

- Obtain share capital. Deposit the minimum share capital requirement, typically €1,200 for an Ltd.

- Appoint directors and secretaries. Identify individuals to serve as directors and a company secretary.

- Draft and register articles of association. Prepare the enterprise’s governing document outlining its objectives, structure, and operations.

- Obtain a tax number and VAT identification number. Register for relevant taxes and obtain the necessary identification numbers.

The registration process in Cyprus will be most helpful with the assistance of an agent in the territory of the Republic, management, and a director, along with a shareholder.

Company Formation in Bulgaria

Bulgaria is an enticing option for businesses with a low corporate tax rate, robust infrastructure, and a skilled workforce — an ideal gateway to Eastern Europe and beyond.

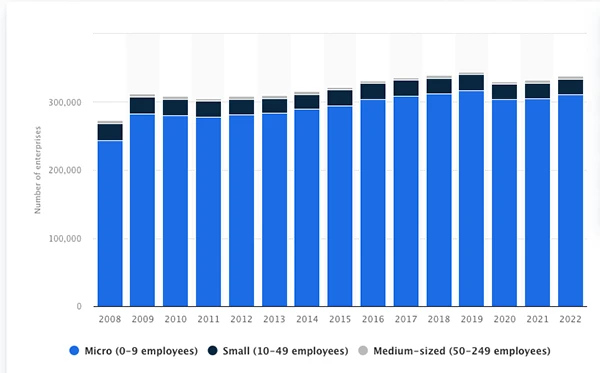

The graph below shows the growth of micro, small, and medium businesses in Bulgaria from 2008 to 2022.

Here are the key steps in company formation in Bulgaria:

- Reserve a company name. Secure the desired business name through the National Register of Legal Persons.

- Determine legal entity. Opt between a Limited Liability Company (LLC) or a Joint Stock Company (JSC).

- Obtain share capital. Deposit the minimum share capital requirement, typically BGN 2,500 for an LLC.

- Appoint directors and a representative. Identify individuals to act as directors and enterprise representatives.

- Prepare and submit articles of association. Draft the business’s governing document outlining its objectives, structure, and operations.

- Record with the commercial register. Apply for registration with the Commercial Register, which grants legal recognition.

If you are a non-resident business, then a representative office can be established with the right to conduct business under Bulgarian law.

Company Formation in Hungary

Hungary provides a stable economic environment and attractive tax benefits for businesses.

With its strategic location, skilled labor pool, and supportive government initiatives, it’s a promising destination.

These are the relevant steps for forming a company in Hungary:

- Choose a company name. Check for name availability and ensure it complies with Hungarian naming regulations.

- Select a legal entity. Opt for a Limited Liability Company (Kft.) or a Public Limited Company (Rt.).

- Deposit minimum share capital. Meet the minimum share capital requirement, typically HUF 3 million for a Kft.

- Appoint directors and a supervisory board (for Rt.). Identify individuals to serve as directors and a supervisory board (if applicable).

- Prepare and draft articles of association. Draft the business’s governing document outlining its objectives, structure, and operations.

- Apply for tax registration. Register for relevant taxes and obtain the necessary identification numbers.

The complete business registration process is quite fast in Hungary with only 1-2 days.

DO YOU KNOW?

For Hungarian company formation, you will get an EU VAT number immediately so you can start working and enjoy the 9% company income tax in 24-48 hours.

Conclusion

Understanding company registration nuances in Europe is vital as it is one of the most preferred business locations.

It has a diverse market with access to top talent that will help set up your company management and operations.

They also have access to the latest technology and their strategic geographic location has many export and import benefits.

Exploring the unique advantages of Cyprus, Bulgaria, and Hungary empowers entrepreneurs to position their businesses strategically for success.

This guide provides valuable insights for navigating European company registration with confidence.