Revolutionizing Financial Flows: Exploring the Dynamics of Cutting-Edge Money Transfer Services

Money transfer is probably the most important thing across borders. And just to point out the significance of money transfer services.

There have been some groundbreaking advancements that revolutionized how funds should move across countries with unprecedented velocity, safety, and productivity. Also, learn about Waves Of Financial Markets with this guide.

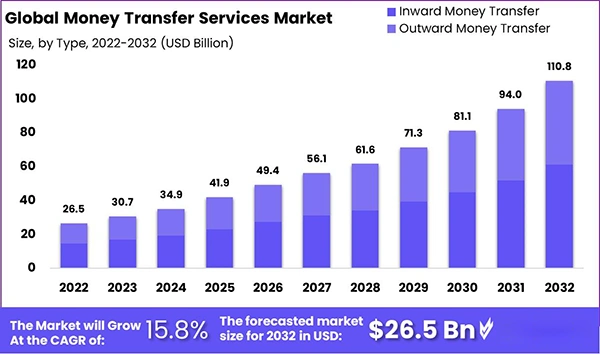

And do you know with these advancements in the go, the market size of money transfer services has reached a phenomenal mark of $36.49 with an annual growth rate of (CAGR) 16.2%?

So, in this read, we will be exploring all the technical stuff behind this advanced money transfer service along with how blockchain and AI-driven security protocols have been revolutionizing financial flows.

The Emergence of Blockchain in Money Transfers

Blockchain is a decentralized technology that records, tracks and validates transactions without any intermediaries like banks and other financial institutions.

And in the field of money transfer, refers to the proper application of a decentralized structure, where every transaction is transparent, and everyone holds a copy of the entire transaction history.

This significantly eliminates the need for trust in a centralized authority, while providing a secure platform where the risk of corruption and data manipulation is greatly reduced. ‘

How Blockchain in Money Transfer Actually Works?

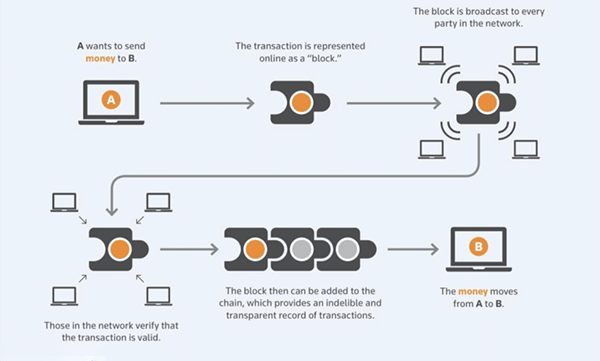

So, to clearly demonstrate the process, when a sender sets up a money transfer request, its details are reflected in a network of computers called nodes.

These details are grouped with other transactions to form a block, which is then added to a pre-existing blockchain network.

This whole action generates a unique transaction ID containing the sender’s and receiver’s details along with the amount to be transferred.

And after the successful transaction of the money, the details are then sealed with a digital signature that cannot be altered by anyone else.

Blockchain technology in the money transfer system makes the system resilient against data corruption and manipulation by reflecting the transactional details across the network of nodes.

Attractive Benefits of Blockchain in Money Transfer

Now that you have a little background on how blockchain technology works in money transfer. Let’s not take a look at some of its striking benefits.

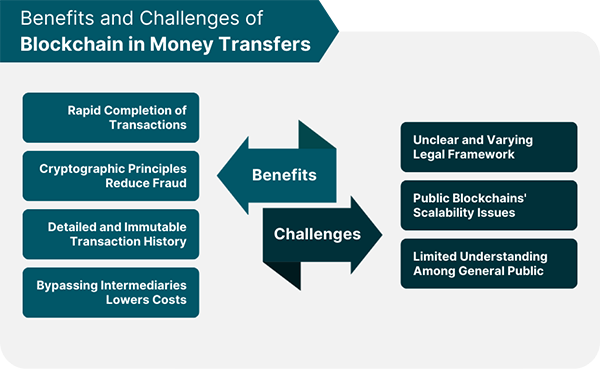

- Speed and Efficiency: The traditional banking system used to take several days to process an international transaction, but with blockchain technology, it can be completed in minutes. This enhances the speed and efficiency of the transferred money.

- Security and Fraud Reduction: Blockchain is a decentralized technology with a transparent network that significantly reduces any kind of fraudulent threat.

- Transparency and Traceability: Transparency in the system provides a detailed transactional history with full traceability that makes it a useful tool during dispute resolution.

- Lower Costs: Blockchain money transfers do not require any intermediary, which also significantly reduces their charges, making it a compelling option for international remittances.

Do You Know?

According to Statista, the transaction value in the digital remittance market is projected to grow at an annual growth rate (CAGR 2024-2028) of 4.76%, resulting in a total amount of US$181.60bn by 2028.

Challenges and Limitations of Blockchain in Money Transfer

Besides these striking benefits, multiple challenges come with a blockchain money transfer. Below are mentioned just a few of them.

- Regulatory and Legal Concerns: Probably the biggest concern with blockchain in money transfer is its regulatory uncertainties. The legal framework differs vastly across jurisdictions, leading to a sense of risk for users.

- Technical Challenges and Scalability Issues: Another major problem with blockchain transfer is that it can experience scalability issues. However, the solution to these concerns is still under development, but it is yet to occur.

- Public Acceptance and Understanding: Despite its numerous benefits, the technology is still unknown to the wider audience. This can cause hesitancy in adopting blockchain technology for money transfers.

AI-Driven Security Protocols

Security is always a paramount feature of an efficient financial system. And this is where Artificial intelligence is emerging as a fine incorporation into the payment system.

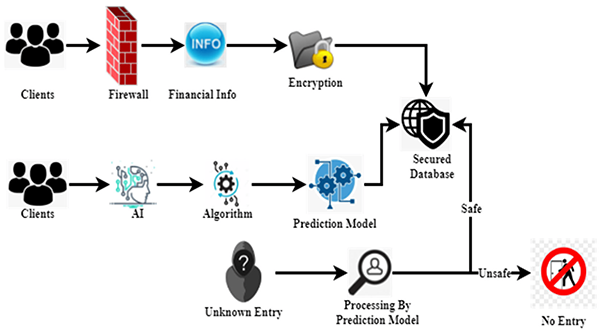

AI in the money transfer system refers to the proper deployment of machine learning algorithms, predictive analytics, and other AI systems to manage and secure transactions.

And as one of the major concerns of the transaction industry, AI technology significantly contributes to ensuring the high-quality security of payments with the help of detection and authentication processes. Let’s take a look at them one by one:

- Detecting and preventing fraud: AI technology is efficient in continuous monitoring and real-time analysis. This makes it an efficient tool for detecting any unusual transactions and taking preventative measures according.

- Enhancing authentication processes: Through proper implementation of the AI algorithms, biometric recognition and multifactor authentication can also strengthen the security of the payment system.

Final Thoughts

As the technology matures, the future of the money transfer system looks bright. The system tackles some of the major concerns of the transaction records, such as transparency and fraud detection.

Additionally, the proper integration of blockchain, AI, and other emerging technologies, is making waves in the transaction system. By making it more secure and less time-consuming.