Navigating the Economic Storm: A Small Guide on How to Combat Inflation and Safeguard Your Finances

In a time of shaky economies and changing market trends, figuring out how to tackle rising costs is vital for folks wanting to feel secure with their money. With the world’s economies increasing, knowing how to fight these growing costs and keep your money safe is necessary.

This article is a brief yet detailed guide, giving valuable tips and plans for people to keep their finances steady during tough economic times. We’ll look at innovative ways to invest and wise personal finance management skills.

These will help readers thrive financially despite the rising costs. You’ll learn what steps to take to strengthen your financial standing and navigate the complex waters of an always-changing economy.

Inflation’s Effect on Lending Niche

Inflation affects the loan sector, touching both those who lend and borrow. It leads to a climb in the cost of goods and services over time, reducing the buying power of money. Getting even the smallest loan in minutes for unplanned expenses may seem a burden. There is a simple explanation of why and how inflation affects the lending industry:

- Higher Borrowing Costs. Central banks often raise interest rates to manage the economy if inflation goes up. It means higher costs for those seeking loans due to higher interest rates. They may have to pay more or borrow less.

- Increased Lending Risk. It adds unpredictability to the loan market, affecting risk evaluations. Lenders might tread more carefully, especially with long-term loans with uncertain future money value. This wariness can lead to stricter lending rules and deeper checking of borrowers’ credit ratings.

- Asset Importance and Security. Inflation can change what borrowers use for collateral, like home value. The price increase of stuff like houses may also go up during this situation.

But, lenders should keep an eye on the actual value because inflation can mess up prices. Borrowers want to use things that grow more valuable with price increases as collateral. It could change what people are offering as collateral.

- Actions by the Government. The government might fight inflation with strategies like tweaking monetary policies or fiscal measures. These actions can indirectly change the loaning world by playing with interest rates and the state of the economy.

- Impact on How People Act. It can make people change how they spend their money and what they think is vital. The change can affect the kind of loans they want, like personal, home, or business loans.

Interesting Fact

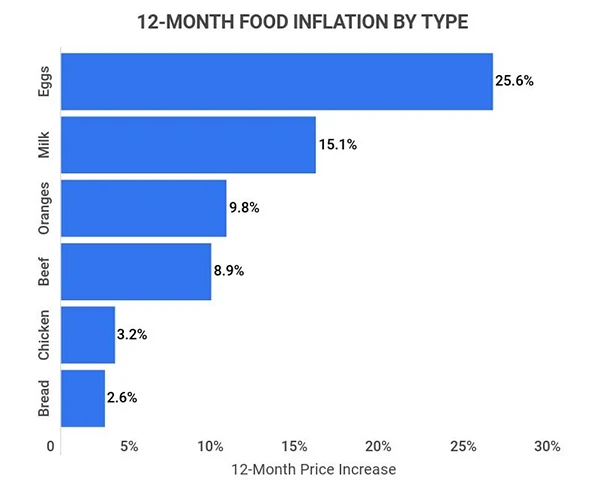

The above graph shows the inflation of 12 months on different food items in the United States. Eggs were the most inflated food item in these 12 months, with an inflation rate of almost 25.6%.

How Does Inflation Affect Savings?

Think of it, like a slow hike in the cost of goods and services over time. It’s an economic event that can powerfully tweak aspects of a person’s money matters. For instance, personal savings. Grasping how inflation sways savings is vital for anyone who manages their finance wisely amid economic twists and turns. Here are some major factors:

Buying Power Loss

Inflation chips away at the purchasing power of money over time. As the cost of stuff you buy increases, the same amount of cash can buy fewer things. It means the true worth of savings goes down. Your money doesn’t stretch as it used to.

Nominal vs. Real Returns

Consumers earn a small interest rate when they save funds in regular savings accounts or low-interest investments. But if inflation is more significant than the interest gained, the real return might be less than nothing. It means that your account balance might go up, but the actual buying power of your savings goes down.

Effect on Fixed-Income Investments

Inflation’s tough on folks with fixed-income stuff like bonds. These usually have a fixed interest rate. The actual worth of the interest income drops when it increases. Inflation eats into the future cost of fixed income. It could mean less buying power when you retire.

Pushing Riskier Investments

To fight the effects of inflation, some might think about riskier things to invest in that might give higher returns. Riskier investments might offer more significant returns, but they also come with ups and downs, and you could lose money. Anyone thinking about saving needs to consider seriously how much risk they’re okay with and what their goals with investing are.

Price Boost of Assets

It might bump up the value of assets like real estate and stocks. It is suitable for those investing in these, but not for people saving to buy a house or enter the stock market as the cost rises.

Action Changes

High rates of inflation might make some people spend, not save. Cash becomes less appealing when its value declines quickly. It could affect the economy’s bigger picture. It impacts all savings rates and the economy’s steadiness.

Price increases can deflate the actual worth of savings, sway returns on investments, and modify how we save and spend. To counter inflation, people should consider investments that can outpace it and regularly check their savings and investment plans against the economy.

DO YOU KNOW?

There is a term called ‘hyperinflation’, which occurs when the price of goods and services increases rapidly in a short period. This happened in Germany during the First World War in 1920.

How to Fight Inflation? Tips & Tricks

Tackling inflation means executing strategies to limit its effect on your money and assets. It continuously decreases money’s value, so finding techniques to conserve and increase wealth is necessary. Here’s how to battle inflation:

Put Money in Inflation-Beating Assets

Think about designating part of your portfolio to assets that typically exceed inflation. Stocks, property, and commodities are examples. These investments might increase in value, which can offset the impact of inflation.

Spread Your Investments

Spreading your investments minimizes risk by diversifying asset types. Mixing up investments might lessen inflation’s toll on your total portfolio. Various assets react differently to economic changes, offering a safety buffer.

Buy Treasury Inflation-Protected Securities (TIPS)

TIPS are government bonds that offer explicit protection against inflation. They recalibrate their principal amount based on Consumer Price Index (CPI) variations. Although they guard against the price rise, their yields may be comparatively low.

Look at High-Yield Investments

High-yield investments present more significant risks but might provide high returns that exceed inflation. Dividend-yielding stocks, high-yield bonds, and certain property investments are examples.

Real Asset Investment

Investing in tangible assets like real estate and commodities can protect your wealth from inflation. These assets hold inherent value and can grow over time. Real estate can offer rent money and chances for value increase.

Regular Investment Check-Up

The economy and inflation fluctuate. Consistently check your investments and update them as required. Fine-tune your portfolio to match your financial aspirations and risk levels.

Emergency Savings Importance

A solid emergency fund can assist you with sudden costs without selling investments in an unfavorable market. It stops forced selling when inflation might affect asset prices.

How to Save Money During Inflation?

In times of inflation, strategically securing your buying power is the need of the hour. As it chips away at money’s worth, it’s required to lessen the blow. Here’s a guide to bucking up your savings during inflation:

- Smart Investing. Assets like stocks, real estate, or commodities usually overtake inflation. Think about putting your money here. Spread your bets among different investments. It may lower the risk and give better returns.

- Emergency Cash Stash. Keep a sizable emergency fund where you can get it fast. Try creating a high-yield savings account. It helps you handle surprises without resorting to expensive debt on cash-back credit cards.

- Budget Planning. Make a budget and stick with it. Checking what you earn and spend can show you where to save more.

- Trimming Excess Costs. Figure out what costs you don’t need and stop spending there. Focus on needs over wants when a price rise hits.

- Bargain on Bills. Bargain for better deals with service providers. They may cut you a deal to keep you around.

- Cut Down High-Interest Debts. Pay off debt with high interest. It can lessen your interest payments and give you more funds to save.

- Investments tied to Inflation. Look into investments like Treasury Inflation-Protected Securities (TIPS) or inflation-indexed bonds. These investments are built to fight price hikes.

- Asset Strategy. Change your investment spread based on your risk comfort and money goals. Check and adjust as required.

Remember, saving during inflation is about preserving and growing your buying power. A varied, thoughtful money plan (even a meal plan) can help you face these economic challenges. Talking to a financial advisor to customize these tips to your unique money situation and goals is wise. If you find this post, share it with your friends and family groups.