Advice & Techniques on State Taxation for Independent Contractors

Professionals seeking independence and flexibility are choosing freelance work more and more often as their career. The responsibility of handling one’s own finances, including paying taxes, comes with freedom, though.

Optimizing tax savings and filing taxes efficiently are frequent challenges faced by freelance consultants. The subtleties of state policies on independent contractors will be discussed in this article, along with advice on how to handle the tricky field of tax planning.

The fundamentals of 1099 employee taxes and self-employment taxation

It is your responsibility to pay your own taxes since, as a freelance consultant, you are regarded as a contractor. Freelancers receive a 1099 form from their clients that lists all of the earnings they have earned year-round, as opposed to traditional employees who receive a W-2 form. Filling out this form is necessary if you want to accurately report your 1099 employee income to the IRS.

The self-employment tax is a significant burden for those who are their own boss. The Medicare and Social Security taxes that are due by both employers and employees are covered by this tax. With 2.9% going toward Medicare and 12.4% going toward Social Security, the current self-employment tax rate is 15.3%. The fact that this surcharge is additional to your normal income policies should not be overlooked.

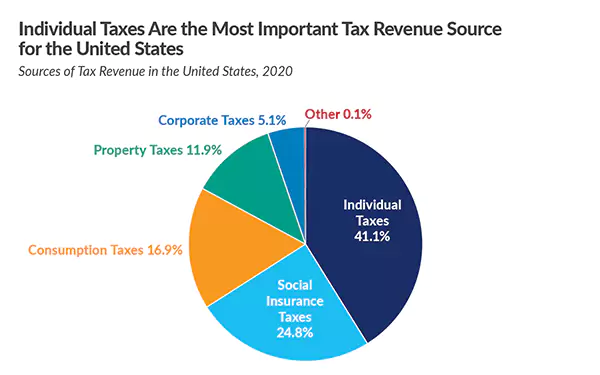

This pie chart shows a clear image of the percentage of different sources of tax revenue in the US, in 2020.

Maintaining an advantage: Quarterly tax payments

Freelancers must make estimated payments on a quarterly basis, in contrast to regular employees who have them deducted from their pay. Your entire income liability for the year is supposed to be covered by these payments. Penalties and interest may be assessed for nonpayment of these obligations.

Estimating your yearly payments and calculating your expected liability are necessary steps to figure out how much you should pay in quarterly taxes. For contractors, who might see monthly payment fluctuations, this can be difficult. To guarantee accurate estimates, it is advised to speak with an IRS expert or make use of online calculators.

State tax deductions for freelancers: Optimizing tax savings

Utilizing state tax deductions is one of the most significant ways independent contractors can reduce their federal taxes. States have different deductions than the federal government, even though all taxpayers can deduct federal taxes. Learning about the policy laws in your state and determining which deductions are relevant to your freelance consulting business is necessary.

Travel expenses, office supplies, equipment, and professional development courses are examples of business-related expenses that freelancers frequently deduct from their state taxes.

States may also allow deductions for home office expenses, retirement contributions, and health insurance premiums. Your taxable amount can be decreased, and your savings can be increased by closely monitoring and recording these costs.

DID YOU KNOW?

State government tax collections totaled $1,090.2 billion in fiscal year 2019, up 5.3% percent from the $1,035.0 billion collected in fiscal year 2018.

Successful tax planning techniques for independent consultants

In order to minimize their liability and guarantee compliance with state laws, independent contractors must engage in effective planning. Take into account the following tactics:

- Maintain accurate and organized records: Accurately filing requires that you keep meticulous records of your income and expenses. To expedite this procedure, use accounting software or employ a bookkeeper with experience.

- Maintain a distinct bank account and credit card for your freelance consulting business: Establish a business and personal financial division. You can avoid combining your personal and business finances by keeping track of business-related expenses more easily with this division.

- Think about establishing an LLC: Depending on your situation, creating an LLC could protect your personal assets and offer benefits. To ascertain if this is a feasible choice for you, speak with a business attorney or specialist.

One way to help freelancers who don’t have access to employer-sponsored retirement plans is by making contributions to retirement accounts. To help you save for retirement and to benefit from advantages, you can still make contributions to SEP and IRAs, or individual retirement accounts.

In conclusion

When working as a freelance consultant, navigating state tax laws can be challenging. However, with the right attitude and preparation ahead, you can minimize your taxes and file them quickly. Staying on top of your obligations can be achieved by becoming knowledgeable about the intricacies of self-employment tax, 1099 employee taxes, and quarterly tax payments.

Also, you can reduce your liability and guarantee that state laws are followed by utilizing efficient strategies and state tax deductions. In order to make the most of your freelance consulting business when abiding by the law, don’t forget to seek the advice of a professional to customize these suggestions and tactics to your unique situation.