Innovative Solutions: How Cloud Services are Revolutionizing Banking Operations

In 1997, During his speech at the World Developer Conference, Steve Jobs (founder of Apple Inc.) said,

“It’s faster in every case to talk to the server than it is my local hard disk… Carrying around these non-connected computers — with tons of data and state in them — is byzantine by comparison”

And Did you know?

The cloud computing market grew from $24.63 billion in 2010 to $156.4 billion in 2020. A straight 635% jump and according to respected research it is going to surpass $1 trillion by 2028.

There is no doubt in the fact that cloud computing technologies have a major significance in revolutionizing banking operations from their scalability, innovation, and cost-effectiveness to the customer experience and security.

So in this read, we will explore how these services have revolutionized banking operations along with the contribution of banking cloud services in enhancing user experience.

Let’s start!

Streamlining Operations: Agility and Efficiency in the Cloud

Traditionally banks depended on legacy structure which was somewhat ineffective according to the current technological landscape. Cloud services include cutting-edge technologies artificial intelligence (AI), machine learning (ML), blockchain, and big data analytics to ensure rapid development.

These services not only help banking sectors adapt to technological operations but also meet the client’s needs as effectively as possible. And by a smooth integration of cloud computing services in the banking sector it can easily help them reduce silos and sell a buypass-functional teamwork.

Enhanced Data Management: Leveraging Big Data in Cloud Banking

The need to ensure that the client’s data is safe and secure is a vital factor in banking service and cloud computing provides a perfect solution to this problem. Where it works as a garage to process and secure this indispensable data for the banks.

Cloud computing services can benefit banks to get valuable insight into customer behavior alternatives, and market inclinations. further enhancing their danger management system.

Cost Savings and Scalability: Driving Financial Efficiency

One of the major benefits of incorporating cloud computing services in the banking sector is its cost-saving and scalability which not only optimize infrastructure costs but also maintain a high-performance standard. Cloud services provide Pay-as-you-go pricing models in IaaS and PaaS to reduce capital expenditure (CapEx).

It significantly reduces the amount of money spent on hardware and purchases the physical space. It helps the financial sectors to expand their services while enhancing the customer experience.

Cloud computing services can also reduce the number of required IT workers along with the amount of time and infrastructure needed for the administration. It is not only a way to save a huge chunk of money but also an opportunity to scale their services.

Did you know that?

Data centers are responsible for approximately 2% of global emissions of greenhouse gases.

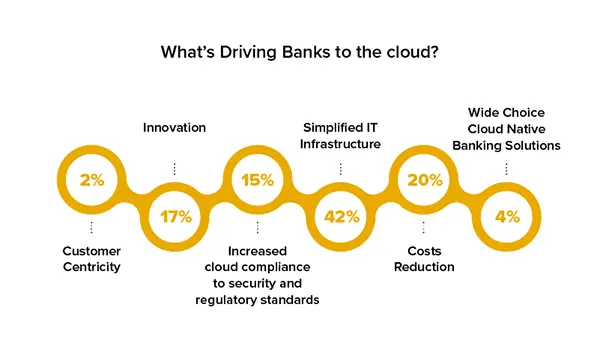

Future Outlook: Anticipating Trends in Cloud Banking Innovation

No doubt that the banks of 2030 will look entirely different from what it is today. The leaders of the banking and financial sectors are recognizing clouds as more than just a technology, they are a destination for banks and other financial services to secure data and analyze it over the Internet.

Cutting-edge technologies like artificial intelligence (AI), machine learning (ML), and blockchain can look at the units in actual time, enhancing fraud detection, customer support, and hazard management.

Conclusion

In closing, the integration of cloud computing services in potential banking operations has transformed banks and other financial industries, empowering them to innovate and deliver exceptional customer services.

And by leveraging cloud services effectively banks can achieve scalability, cost efficiency, and security along with their continuous innovation and growth in the digital realm.

Thanks for reading!

Frequently Asked Questions

Ans: Cloud computing is the delivery of computer services that include databases, storage, networking, servers, analytics, software, and intelligence over the internet (The Cloud ) for faster innovation and scalability. For example, audio or video streaming platforms where the actual files are stored remotely.

Ans: There are majorly 6 benefits of cloud computing in banking and financial services, it includes:

- Cost-effectiveness

- Froud detections

- better customer relationship benefits management

- greater scalability

- tightened security and

- compliance with the respected regulations

Ans: Cloud computing helps the banking sector achieve a greater level of fault tolerance along with a massive level of redundancy at once and backup at a low cost. it also consists of every ingredient to make it future-proof.

Ans: Yes, it offers bank-level encryptions to keep the most sensitive information safe, providing one of the safest solutions for its security.

Ans: Shortly with the help of cloud computing banks can easily access the latest security protocols, and get real-time updates on customer activities, utilizing effective analytical tools. Along with that banks can also save time on hardware maintenance and storage space costs.